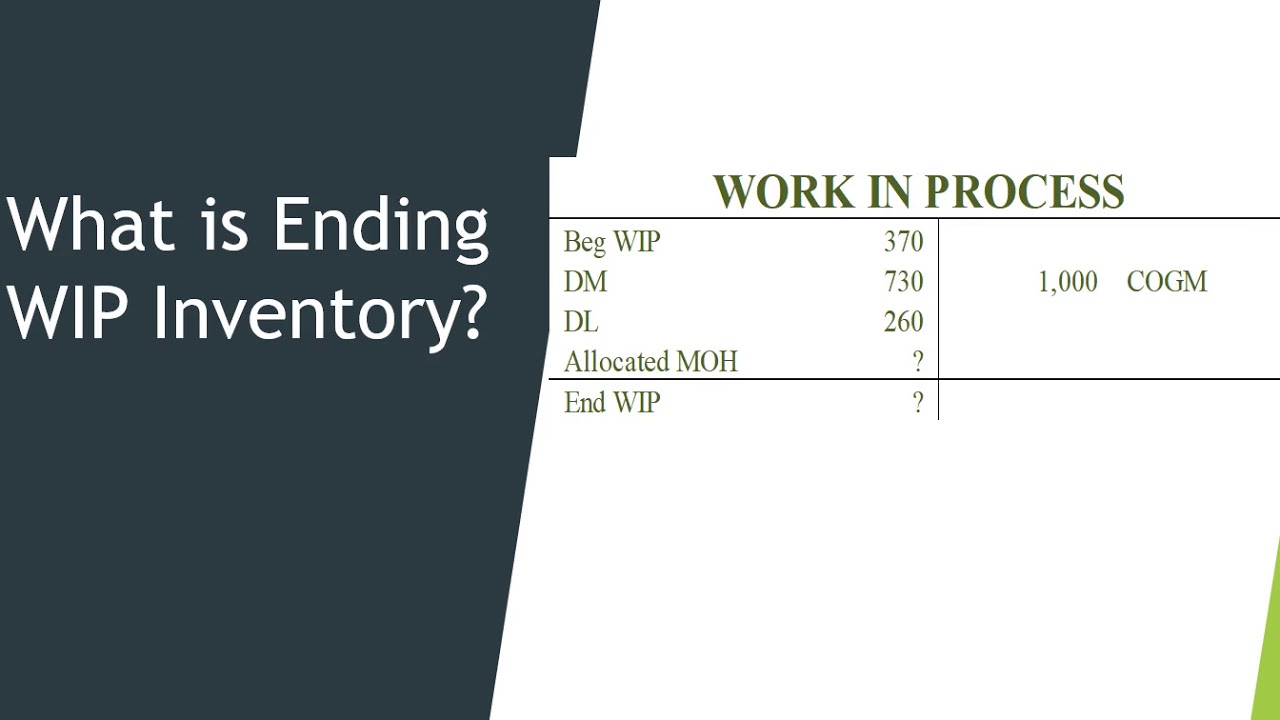

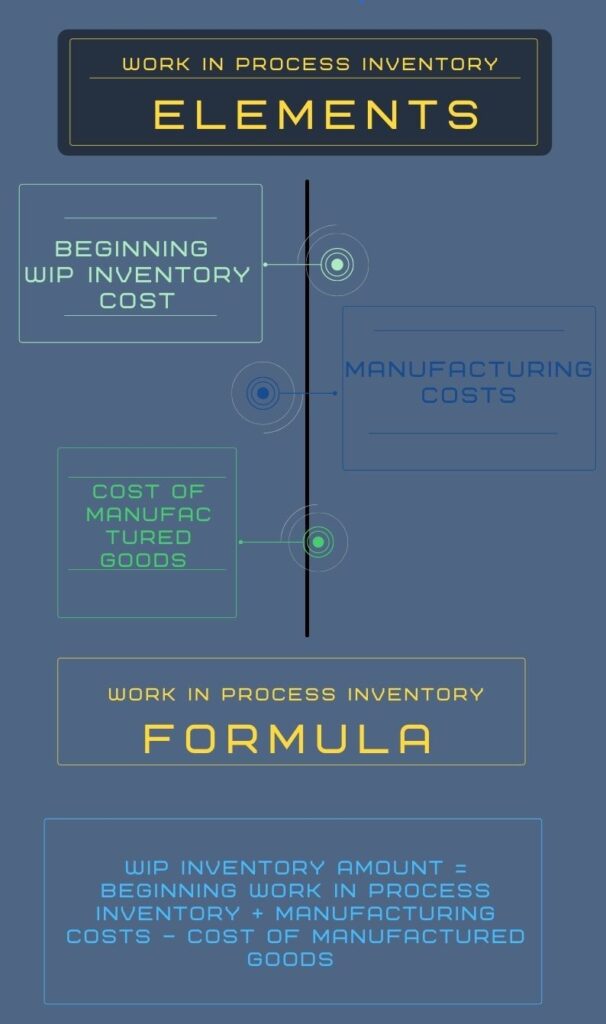

work in process inventory formula

Work In-process Inventory Example. Work in process WIP work in progress WIP goods in process or in- process inventory are a companys partially finished goods waiting for completion and eventual sale or.

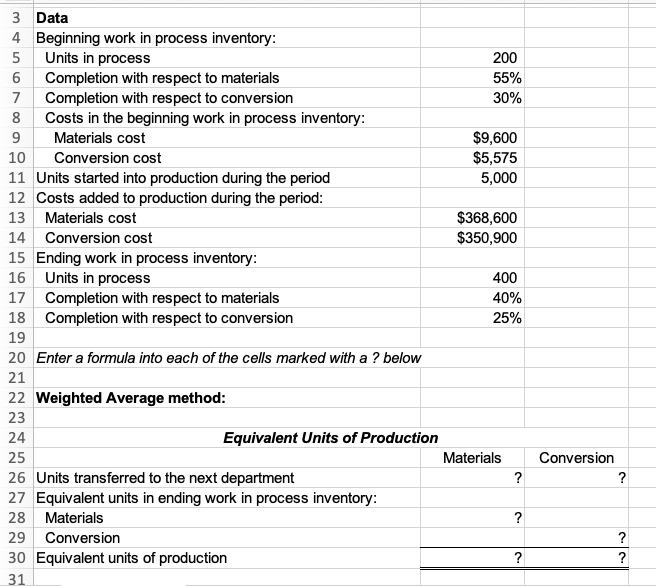

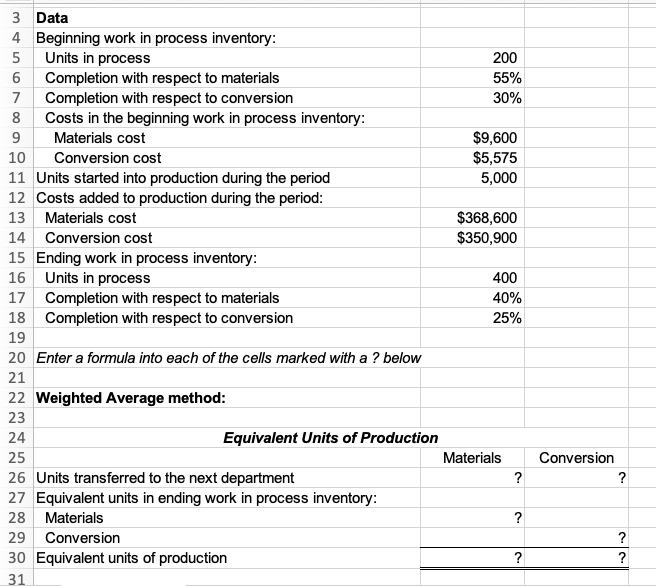

Solved 3 Data 4 Beginning Work In Process Inventory 5units Chegg Com

Keep in mind this value is only an estimate.

. Work in process inventory formula. Assume Company A manufactures perfume. Every dollar invested in unsold inventory represents risk.

Work in process inventory examples. Ignoring work in process calculations entirely. Labour cost of 5000 and other.

It doesnt take into account waste scrap spoilage downtime and MRO inventory. In the new year you spend 150000 on manufacturing costs. Learn how to classify work in process inventory to increase the efficiency of your inventory management operations.

Ending WIP inventory beginning WIP inventory manufacturing costs COGM. Work in Process Inventory Formula. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP Inventory.

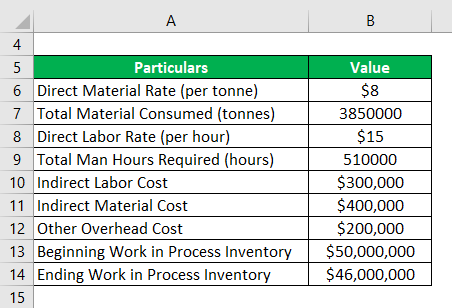

Ending WIP is listed on the companys balance sheet along with amounts for raw materials and finished goods. Total Cost of Manufacturing Beginning Work in Process Inventory Ending Work in Process Inventory Cost of Manufactured Goods. Inventories 302 M 8181 1120 M.

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. The formula for calculating WIP inventory is. Beginning WIP Manufacturing costs - Cost of goods manufactured Ending work in process.

Therefore the formula from which a business can calculate their COGM using work in process inventory costs can be displayed like this. For the exact number of work in process inventory you need to calculate it manually. Work in Progress Inventory Formula Initial WIP Manufacturing Costs Cost of Goods Manufactured Costs - Cost Of Goods Manufactured Cost of Goods Manufactured Formula is value of the total inventory produced during a period and is ready for the purpose of sale.

Once you know your beginning WIP inventory manufacturing costs and COGM you can start to use the WIP inventory formula. The last quarters ending work in process inventory stands at 10000. And the result for calculating beginning inventory cost will be as follows.

Work in process inventory 60000. After the beginning WIP inventory is determined along with the manufacturing costs and the COGM its easy to calculate the amount of WIP inventory that you currently have. Vehicles within the manufacturing plant move along an assembly.

Works in process WIP are included in the inventory line item as an asset on your balance sheet. How do I account for work in progress inventory. Work in process inventory formula.

Example of the Ending Work in Process Calculation. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period. Heres how youll need to do it.

Some inventory might have one stage of machining done and other inventory might have all but one stage of machining done. Definition Formula And Examples Charisma Motors is a commercial car manufacturer specializing in sedans cross-overs and SUVs. Once you have all three of these variables the formula for calculating WIP inventory is.

Total Manufacturing Costs Beginning WIP Inventory Ending WIP Inventory COGM. The cost of manufacturing is considered in the raw materials account the work in progress account. Pretend you own a hat brand and your store has a.

Formulas to Calculate Work in Process. The formula for calculating WIP inventory is. Accounting with Opening and Closing Work-in-Progress-FIFO Method.

The formula for calculating the WIP inventory is. The standard work in process inventory definition is all the raw material overhead costs and labor associated with every stage of the production process. That makes it a part of manufacturing inventory see.

The calculation of ending work in process is. To calculate your in-process inventory the following WIP inventory formula is followed. Any raw material inventory that has been combined with human labor but is not yet finished goods inventory is work in process inventory.

At any given time a portion of the inventory in a manufacturing operation is in the process of. An important note to consider is that work in process inventory can vary greatly. Beginning WIP Inventory Production Costs Finished Goods Ending WIP Inventory.

This means that Crown Industries has 10000 work in process inventory with them. Ending WIP Beginning WIP Costs of manufacturing - costs of goods produced. Beginning WIP Inventory Manufacturing Costs Cost of Finished Goods Ending WIP Inventory.

The WIP figure indicates your company has 60000 worth of inventory thats neither raw material nor finished goodsthats your work in process inventory. Take a look at how it looks in the formula. Pretend you own a hat brand and your store has a.

Work in process inventory includes all raw goods production expenses and labor costs associated with producing merchandise inventory. 514 M จาก Q2 finished goods 157 M work in process ลดเลกนอย raw materials 517 M spare parts 2 M วสดสนเปลอง-แมพมพ 34 M goods in transit 209 M. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods.

WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS. 8000 240000 238000 10000. Likewise what does work in process mean.

Work In Process Inventory Wip. Once youre able to determine your beginning WIP inventory and you calculate your manufacturing costs as well as your cost of manufactured goods you can easily determine how much WIP inventory you have. The difference between the sum of the beginning work in process and the costs of manufacturing is the ending work in process.

However by using this formula you can get only an estimate of the work in process inventory. Work-in-Process Inventory Formula. The work-in-process WIP inventory account shows the units that have entered the production process but are not completed.

The formula is as follows. If your head is spinning with all these figures dont worry. And long story short heres the formula.

The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the volume of production activity. WIP Inventory amount Beginning Work in Process Inventory Manufacturing Costs Cost of Manufactured Goods Work in Process VS Work in Progress. Work in process inventory calculations should refer to the past quarter month or year.

In this formula COGM cost of goods manufactured.

Solved 200 55 30 9 600 5 575 5 000 3 Data 4 Beginning Chegg Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Ending Work In Process Double Entry Bookkeeping

Inventory Formula Inventory Calculator Excel Template

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

What Is Work In Progress Wip Finance Strategists

What Is Work In Process Wip Inventory Eswap

Cost Of Goods Manufactured Formula Examples With Excel Template

What Is Work In Process Inventory And How To Calculate Wip

Manufacturing Account Format Double Entry Bookkeeping

Ending Inventory Formula Step By Step Calculation Examples

Wip Inventory Definition Examples Of Work In Progress Inventory

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Work In Process Wip Inventory Youtube

Cost Of Goods Manufactured Formula Examples With Excel Template