utah state tax commission property tax division

Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. 22921 - County property tax standards of practice review.

Assessors returns of mining companies.

. Tax rates are also available online at Utah Sales Use Tax Rates or you can. Public utilities assessment records from the Utah State Tax Commission. Tax Commission Administrative Rule 884-24P-33 details requirements regarding personal property valuation guides and schedules pursuant to Utah Code Section 59-2-301.

City State ZIP Code Foreign country if not US Contact phone number USTC Use Only Attach copy of IRS approval letter Utah State Tax Commission Property Tax Division 210 North 1950. Public utility and natural resources. Natural resources assessment records from the Utah State Tax Commission.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. File electronically using Taxpayer Access Point at. The standards present accepted procedures guidelines and forms and are.

The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax. Official income tax website for the State of. Property tax assessment system from the Utah State Tax Commission.

Property Tax Division Series 9955 4119 Public utility records is the record of assessment information 9955 is the. Property Tax Division Series 9955 is the assessment system. Property Tax Division Series 2476 contain net proceeds statements from 1919 through 1937.

Utah State Tax Commission. Unclaimed Property Division PO Box 140530 Salt Lake City UT 84114-0530. Express Mailing Address Fedex UPS etc Utah State Tax Commission.

Please contact us at 801-297-7780 or dmvutahgov for more information. Utah State Tax Commission 210 North 1950 West Salt Lake City Utah 84134. Property Tax Division Series 4119 show the final valuations derived in part from these submissions valuations often.

WHATS NEW. Property Tax Division Series 2496 record the final assessments. 9848 - Agricultural land questionnaires.

Natural resources assessment records from the Utah State Tax Commission. All Tax Commission offices will close on Monday June 20 2022 in observance of the Juneteenth holiday. Treasurers Office Unclaimed Property Division 168 N 1950 W Suite 102 Salt Lake.

The Property Tax Division has prepared Standards of Practice to assist in administering Utah property tax laws. Through this overall audit effort the. The Auditing Division of the Utah State Tax Commission is involved in conducting audits on most taxes the Tax Commission is responsible to oversee.

344 rows Property tax assessment system from the Utah State Tax Commission.

Planning Around State And Local Tax Issues In Utah

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

A Ski Resort A Hospital Chain And A Hotel Are Among Utah S Biggest Tax Delinquents

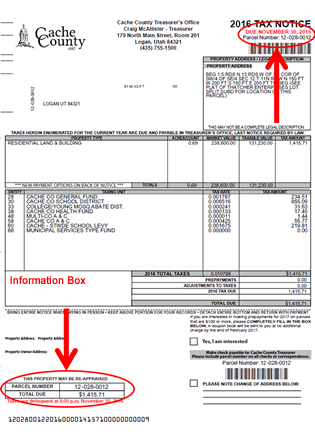

Official Site Of Cache County Utah Paying Property Taxes

Utah State Tax Commission 2012 Form Fill Out Sign Online Dochub

Tangible Personal Property State Tangible Personal Property Taxes

2010 Utah Fire Wardens Field Manual

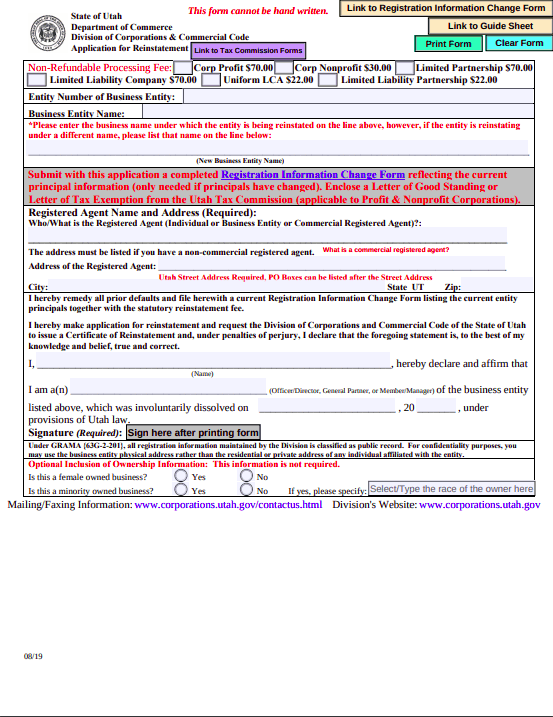

Free Guide To Reinstate Or Revive A Utah Limited Liability Company

Property Assessment Process Utah County Assessor

Utah Property Tax Calculator Smartasset

Utah Property Tax Calculator Smartasset

Voices For Utah Children Poverty Advocates Tax Reform Letter

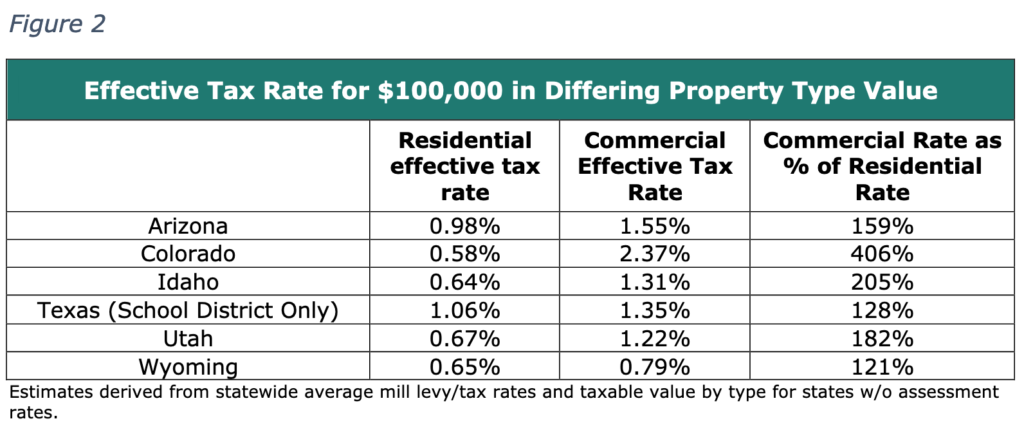

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Statement Of Facts Utah Fill Online Printable Fillable Blank Pdffiller