capital gains tax news canada

And the tax rate depends on your income. The total amount you received when you sold the shares was 5000.

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

For a Canadian who falls in a 33 marginal.

. Your sale price 3950- your ACB 13002650. Net of the 5000 previously-claimed capital gains. Since its more than your ACB you have a capital gain.

Latest news on Capital Gains Tax in the United States where individuals and corporations pay US federal income tax on the net total of all their capital gains. You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. If you bought a cottage for 200000 and now sell it for 500000 you will receive.

On a capital gain of 50000 for instance only half of that amount 25000 is taxable. The inclusion rate is the percentage of your gains that are subject to tax. As of 2022 it stands at 50.

This can be done using Section 1031 of the tax. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. Pay the 50 on your gains then reinvest your money in the same.

When you buy a home you must pay tax on its fair market value at the time of purchase. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Because you only include onehalf of the capital gains from these properties in your taxable.

The sale price minus your ACB is the capital gain that youll need to pay tax on. The inclusion rate has varied over time see graph below. For more information see What is the capital gains deduction limit.

When you sold the 100 shares this year you received 50 per share and paid a 50 commission. In Canada capital gains are taxed at a rate of 50 of the gain if the asset is sold within one year of it being bought and at a rate of 2667 if the asset is held for longer than. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

In 2021 the net capital losses from 2018 can reduce the taxable capital gains to zero leaving 14000 of net capital losses. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. The first way to avoid paying capital gains tax on rental property in Canada is to defer the sale of your property to a later date.

Canadas capital gains tax was introduced in part to finance the growing costs of Canadas social security system and to create a more equitable system of taxation. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

In Canada 50 of the value of any capital gains is taxable. But if were talking about a 25 increase in the capital gains tax Id say sell now while you have the chance. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital.

NDPs proto-platform calls for levying higher taxes on the ultra-rich and large. A Canada Capital Gains Tax Calculator formula that will allow you to manually crunch numbers and get your rate. Capital Gains Tax News.

Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have.

An Overview Of Capital Gains Taxes Tax Foundation

Raising The Capital Gains Tax Would Soak More Than Just The Rich New Analysis Suggests Financial Post

Tax Efficient Investing Strategies Canada Financial Iq By Susie Q

Capital Gains Tax What Is It When Do You Pay It

Taxation Of Investment Income Within A Corporation Manulife Investment Management

High Income Earners Need Specialized Advice Investment Executive

Capital Gains Tax In The United States Wikipedia

Capital Gains Tax News Videos Articles

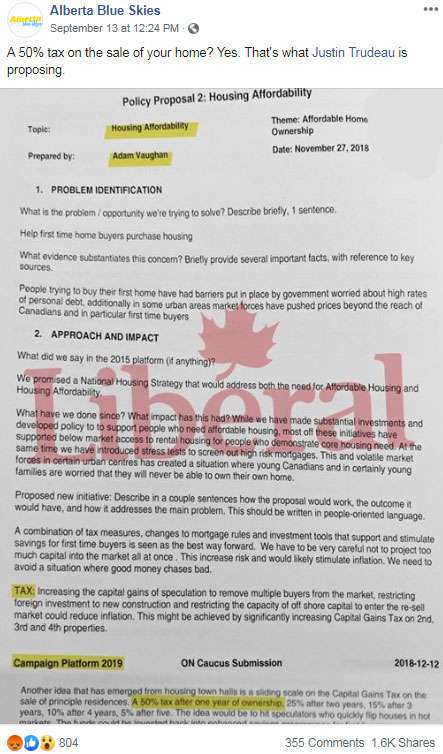

Fact Check Canada S Liberals Plan Capital Gains Tax On Home Sales

What Are Capital Gains Taxes And How Could They Be Reformed

International Tax Treaty Canada Freeman Law Jdsupra

Corporate Taxation Of Investment Income Capital Gains Tax 2019 Canada

Why Won T Canada Increase Taxes On Capital Gains Of The Wealthiest Families Fon Commentaries Vol 2 No 20 Finances Of The Nation

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The States With The Highest Capital Gains Tax Rates The Motley Fool

:format(webp)/https://www.thestar.com/content/dam/thestar/politics/federal/2019/03/29/ndp-leader-jagmeet-singh-targets-rich-with-proposal-to-raise-rate-for-capital-gains-tax/jagmeet_singh.jpg)

Ndp Leader Jagmeet Singh Targets Rich With Proposal To Raise Rate For Capital Gains Tax The Star

The Capital Gains Tax Rate Talked About A Lot But No Change Yet Welch Llp

Double Taxation Of Corporate Income In The United States And The Oecd

Long Term Capital Gains Vs Short Term Capital Gains And Taxes Nasdaq