county tax liens nj

Investing in tax liens in Union County NJ is one of the least publicized but safest ways to make money in real estate. Submit the official document in person or via mail to PO Box 690 Newark NJ 07101-0690.

The Essential List Of Tax Lien Certificate States

CODs are filed to secure tax debt and to protect the interests of all taxpayers.

. What you must do. A tax lien is filed against you with the Clerk of the New Jersey Superior Court. Ocean County NJ currently has 10594 tax liens available as of November 7.

Essex County Tax Board 495 Dr. Ocean County NJ currently has 390 tax liens available as of November 3. In fact the rate of return on property tax liens investments in.

In fact the rate of return on property tax liens investments in. Union County NJ currently has 7375 tax liens available as of November 5. County Tax Administrator Kevin P.

McCann Assistant County Tax Administrator 2745 S Delsea Drive Vineland NJ 08360. 856 451-2891 Additional Links How Property is Valued New. Bid down the interest or premium Redemption Period.

Bergen County Board of Taxation About Board of Taxation The Bergen County Board of Taxation is open to the public and accepting Property Assessment Appeals in person. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

All liens must be against Essex County residents or property. Martin Luther King Jr Blvd Room 230 Newark NJ 07102 Together we make Essex County work. In fact the rate of return on property tax liens investments in Union.

18 per annum Bid Method. According to state law New Jersey Tax Lien Certificates can earn as much as 18 per annum 4 - 6 on the amount winning bidders pay to purchase New Jersey Tax Lien Certificates. Tax Liens Interest Rate.

Investing in tax liens in Bergen County NJ is one of the least publicized but safest ways to make money in real estate. Trenton NJ 08666-0146 609 292-4102 Free Lien Search in New Jersey New Jersey government agencies that preserve land ownership records and business filings provide free lien searches. Investing in tax liens in Middlesex County NJ is one of the least publicized but safest ways to make money in real estate.

Essex County NJ currently has 14955 tax liens available as of November 4. In New Jersey county treasurers and tax collectors sell tax lien. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Monmouth County NJ currently has 8409 tax liens available as of November 7. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

This website has been designed to provide property.

Special Seminar On Tax Lien Investing In New Jersey

How To Buy Tax Liens In New Jersey With Pictures Wikihow

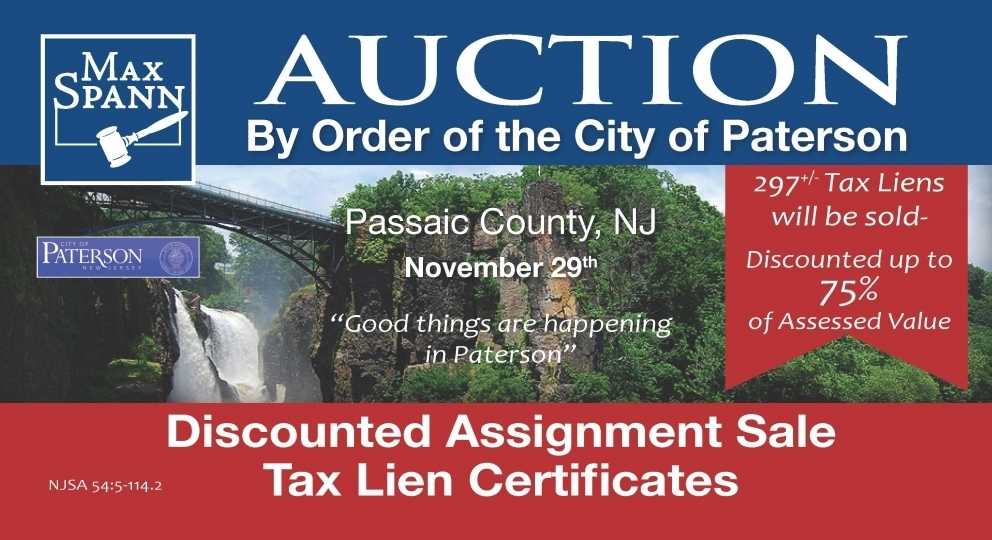

297 Tax Liens Will Be Sold Discounted Up To 75 Of Assessed Value In Paterson Nj

How To File A New Jersey Construction Lien A Step By Step Guide

Gilmore Owes Nearly 5 Million In Tax Liens Judgments New Jersey Globe

New Jersey 2021 Tax Lien Sale Deal Of The Week Youtube

How To Buy Tax Liens In New Jersey With Pictures Wikihow

Understanding Nj Tax Lien Foreclosure Westmarq

Tax Office Franklin Township Nj

Tax Collector Aberdeen Township Nj

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Nj Division Of Taxation Sales And Use Tax

The Official Website Of City Of Union City Nj Tax Department

Phil Murphy Agrees To Reduced Sales Tax In These 5 N J Cities Nj Com